Successful supply chain management in a global component crisis

Throughout 2021, electronic component shortages made headlines across the globe. And few sectors were harder hit than the automotive industry, where chip shortages were disrupting vehicle production all over.

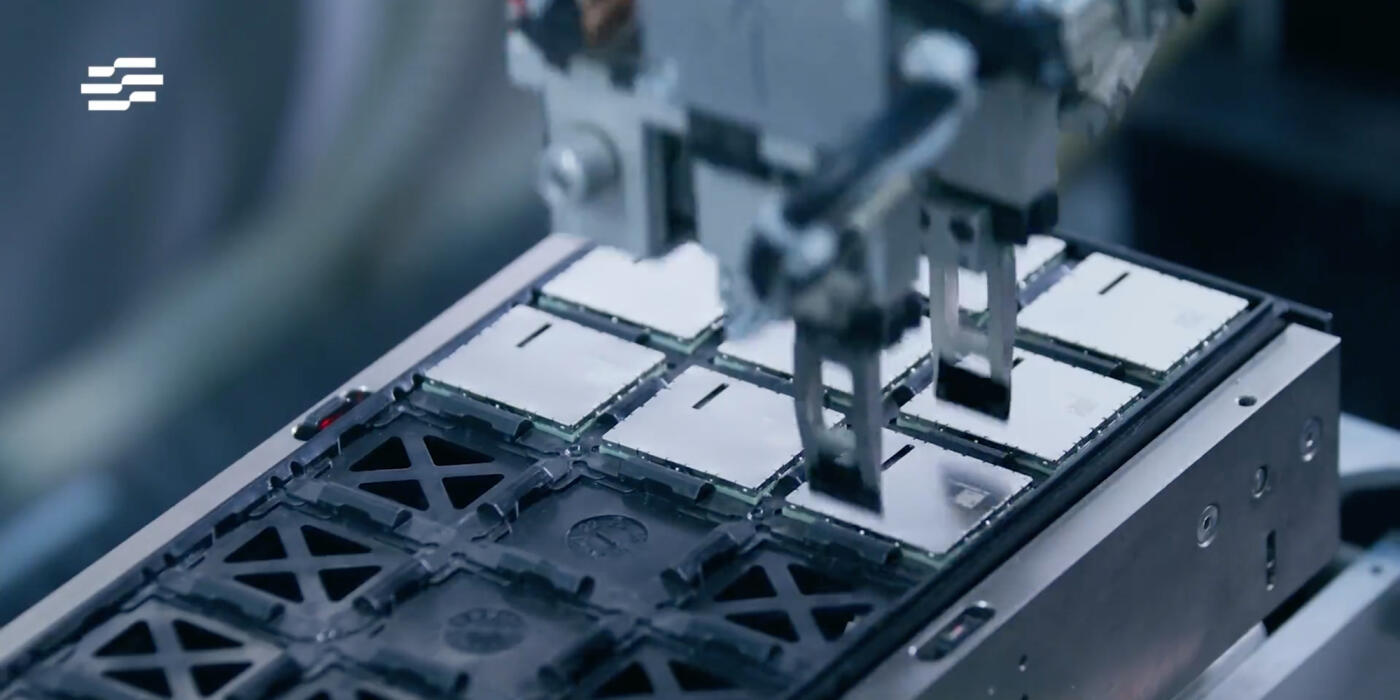

In this exceptional context, the manufacturing and supply of Rolling Wireless automotive modules did not impact a single customer production line. Not only that: Rolling Wireless celebrated its first million-module shipment month in the midst of the crisis, and peaked at over 1.2 millions shipments in a month during the year.

We spoke to Bill Dodson, Senior Vice President Operations at Rolling Wireless, to learn the secrets behind the winning formula.

Q: As a fabless company, how does Rolling Wireless manage its supply chain?

A: We have a weekly planning cycle with our customers, which includes both their demand side and our ability to support from the supply side. This weekly communication means that we're able to react quickly to any changes coming up on the demand side.

Even more importantly, all our sales and operations planning systems are fully integrated. Our customer portal contains both customer inventory levels and customer forecasts. This information is automatically pulled into our SAP system and translated into our forecast, which in turn is integrated with our contract manufacturer’s factory management software.

This integrated process provides excellent end-to-end visibility, from raw material status to customer finished goods. It helps us keep an overall perspective and anticipate potential issues early on: where we have too much inventory, or areas that we need to expedite.

Q: How many different components go into Rolling Wireless’s automotive modules, and how many of them have been in short supply?

A: Each of our products contains hundreds of components, so in total we’re talking about thousands of different parts.

In normal circumstances, we may have shortages of perhaps 10 parts to deal with, 20 parts in a really bad market. But at the height of the shortages early last year [2021], we were managing shortages of up to 80 concurrent parts. At that time, I spent 80% of my time dealing with shortages, an unprecedented type of situation.

Every week, we had multiple meetings with all our key suppliers, and often with customers who wanted supply updates. We also had a formal weekly shortage meeting with our contract manufacturer, where both of us would provide our updates after talking with the suppliers to make sure that we all had the latest information to put into the production forecast and give our customers their commit dates.

Q: Rolling Wireless did not impact any customer production lines during this period. What were the keys to this success?

A: To a large extent, we were able to rely on processes that we had set up in advance to help deal with these potential situations. 2021 was extreme, but even in our normal course of business we can have supplier or quality issues, and we have processes in place to deal with those.

One thing we do to assure customer supply is to try and dual-source as many components as we can for a product. We make sure that we have a certain order flow for those alternative sources of parts, so that we always have a pipeline of material from multiple sources for any given requirement.

This isn’t always feasible, however. There are some parts, like baseband, memory, or PCBs, for which we only have single sources. For these single-source components or long-lead components, we carry additional safety stock, so that when we have fluctuations or quality issues, we have additional stock in reserve.

When we get a customer forecast, we also don't plan just for the forecast. We put a finished goods buffer on top, basically a buffer window with our contract manufacturer, to give us more flexibility. So dual-sourcing, safety stock and finished goods buffers help us manage through these kinds of situations.

But what really saved us during last year’s catastrophic situation was our long-standing relationships with our key suppliers — we’ve been doing business with most of them for 20 years. We have strong executive contacts around the world with these suppliers, so we can get on the phone with their CEO, talk about the situation and get help. So we do get preferential supply treatment, thanks to our relationships with key suppliers.

In short, you need to have a framework for how you manage day-to-day issues, but relationships are also very, very important.

Q: What would you say are the most important qualities for supply chain teams dealing with this kind of situation?

A: You really need to have a kind of a maniacal focus on it, non-stop, 24/7. That's what you're focused on: resolving issues with different parts one by one, checking them off, and looking at all the different options that you have.

In a crisis, you need to be flexible. One of the non-standard things we did was to buy parts out in the open market from distribution and brokers to fill in any supply gaps. We normally don't do this because it comes with a price premium and there is additional testing done on these parts, but we did pay some of these premiums to assure no customer impacts. We also worked our factory 24/7 and spent a significant amount of overtime to make sure that our production lines could keep going.

And when we couldn't find parts, we went back to the engineering teams to look for alternatives. Between the engineering teams, the quality team and operations, we did some emergency qualifications of what we considered low-risk parts to be able to implement them as quickly as possible and do PCN (change notices) for the customers.

Q: Looking forward, what do you see in your crystal ball for the remainder of 2022?

A: Despite the current geopolitical turmoil, we’ve seen a tremendous improvement in supply. We only have a handful of shortages now, so the situation is definitely much more in hand.

What’s also helping us is that we have enhanced and integrated all of our factory planning and production systems — from Salesforce to SAP to Agile — to best manage the end to end business. The peak of the crisis was only a couple of months into our transition from a business unit to an independent company, so it was a very dynamic time in putting the infrastructure and team in place.

So the outlook for the next six months is very positive. We've gone from a focus of just getting parts at all costs, to working with suppliers on cost optimization. It’s a much better discussion to have.